Industry News & Media Articles

Proactive Investors

Huge Rare Earths Discovery is Gamechanger in Americas Trade War with China

At the height of the American war machine’s realization that China controls nearly all of its raw materials, two new developments in Europe now suggest that the West has a fighting chance to secure critical metals for the future: A

First Berlin rate EUR a buy with price target € 0.17

IMMINENT DFS TO OPEN DOOR TO OFFTAKE DEALS AND FINANCING Existing and planned European battery factories are expected to generate over 600,000 tonnes of lithium carbonate equivalent demand in 2025 - the year when we expect European Lithium to

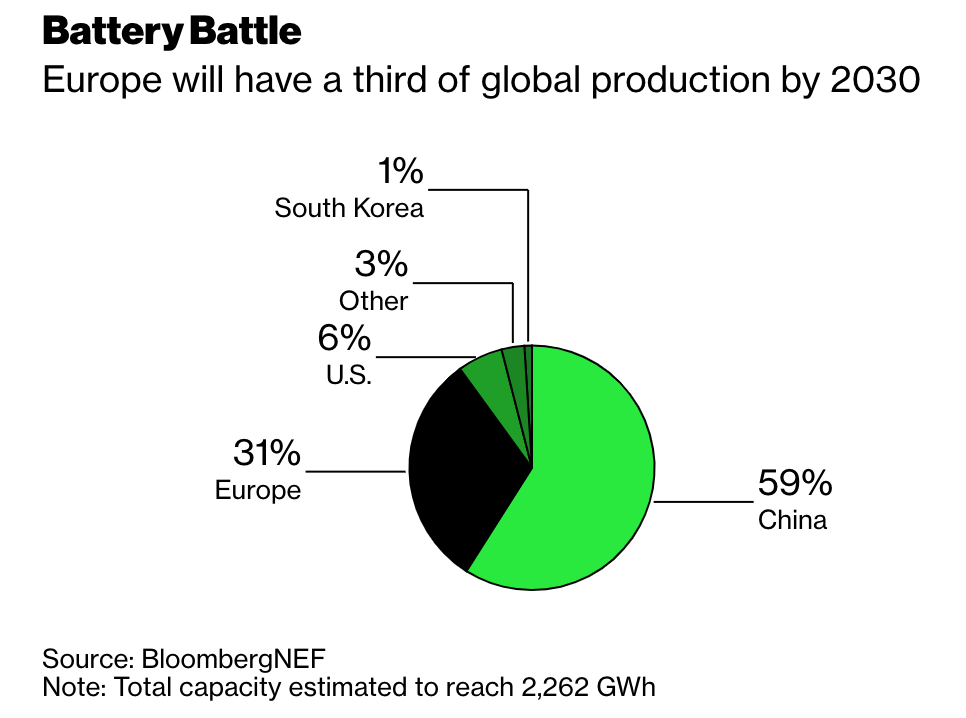

The Next Electric-Car Battery Champion Could Be European

Volkswagen, startups unveil ambitious plans as EV sales surge Continent’s market share could quadruple by 2030: BNEF With Europe expected to lead the world in electric-car sales for a second straight year, an epic rush to build a battery-supply

The electric revolution has become an unstoppable force in 2021

Data from Benchmark’s Lithium ion Battery Database shows battery demand in Europe – the second biggest market behind China — is set to increase at an annualised rate of 40.1 per cent between 2020 and 2025. It’s no wonder manganese, lithium, cobalt, nickel,

EV revolution is bigger than the supercycle, says Friedland

"Unprecedented and revolutionary cycle driven by the rise of green energy and electrification..." The commodities market is not in a so-called supercycle, rather it is at the start of an unprecedented and revolutionary cycle driven by the rise of

‘Back to the future’ as lithium prices soar in China

Lithium carbonate prices have shot up by more than 40% in China in January, according to Benchmark Mineral Intelligence. The price reporting agency said the increase was on the back of continued, surging lithium iron phosphate (LFP) battery demand.

Huge Rare Earths Discovery is Gamechanger in Americas Trade War with China

At the height of the American war machine’s realization that China controls nearly all of its raw materials, two new developments in Europe now suggest that the West has a fighting chance to secure critical metals for the future: A

First Berlin rate EUR a buy with price target € 0.17

IMMINENT DFS TO OPEN DOOR TO OFFTAKE DEALS AND FINANCING Existing and planned European battery factories are expected to generate over 600,000 tonnes of lithium carbonate equivalent demand in 2025 - the year when we expect European Lithium to

The Next Electric-Car Battery Champion Could Be European

Volkswagen, startups unveil ambitious plans as EV sales surge Continent’s market share could quadruple by 2030: BNEF With Europe expected to lead the world in electric-car sales for a second straight year, an epic rush to build a battery-supply

The electric revolution has become an unstoppable force in 2021

Data from Benchmark’s Lithium ion Battery Database shows battery demand in Europe – the second biggest market behind China — is set to increase at an annualised rate of 40.1 per cent between 2020 and 2025. It’s no wonder manganese, lithium, cobalt, nickel,

EV revolution is bigger than the supercycle, says Friedland

"Unprecedented and revolutionary cycle driven by the rise of green energy and electrification..." The commodities market is not in a so-called supercycle, rather it is at the start of an unprecedented and revolutionary cycle driven by the rise of

‘Back to the future’ as lithium prices soar in China

Lithium carbonate prices have shot up by more than 40% in China in January, according to Benchmark Mineral Intelligence. The price reporting agency said the increase was on the back of continued, surging lithium iron phosphate (LFP) battery demand.